BRIEF FROM THE CANADIAN TASK FORCE ON SOCIAL FINANCE AND SOCIAL INNOVATION GENERATION

Executive Summary

The Canadian Task Force on Social Finance and Social Innovation Generation (SiG) are committed to the development of social enterprises and the capital markets that support them.[i] Fiscal and societal challenges have converged to give social enterprise a critical role in generating positive social and economic impact through a financially self-sustaining business model. Social enterprises are a vital and growing part of the fabric of innovating organizations that meet community needs and expand sustainable jobs. Their impact is already significant in Canada: social enterprises are a rapidly growing part of the public benefit sector, whose revenues exceed $200 billion. Social enterprise activity is estimated to grow by over 10% annually until at least 2014.[ii]

Relying on government and the community sector to meet evolving social needs -- while leaving business to seek financial returns -- is not generating sufficient impact to solve our increasingly complex social problems. On the contrary, solutions require new forms of collaboration and multi-sector partnerships. Social enterprises will play a pivotal role in creating the new landscape of public service, one that encourages collaboration across the public, private and non-profit sectors.

Government alone can incentivize the mobilization of private capital serving social enterprise where gaps currently exist:

· There are few incentives or capital supports to develop a robust intermediary infrastructure and spur private capital investment;

· The outdated legal and regulatory framework for social enterprise (a sector including enterprising charities and non-profits as well as for-profit social ventures) limits them from fully developing sustainable, market-based approaches while protecting and remaining accountable to public benefit objectives.

To overcome these barriers, the Canadian Task Force on Social Finance makes three recommendations to the Standing Committee on Finance:

I. Mobilizing Capital

The federal government should stimulate capital market formation by partnering with financial institutions to create national and regional impact investment funds that serve social enterprises.

II. Enabling Private investment via Tax Incentives

The federal government should develop targeted tax incentives to accelerate private capital investment in the social enterprise sector; a multi-sector working group involving the federal government, provincial and territorial governments, and the finance and social enterprise sectors should collaboratively develop specific proposals.

III. Modernizing Legal and Regulatory Frameworks

a) The Finance Department needs to modernize CRA regulations inhibiting charities and non-profits from developing in-house or stand-alone social enterprises (e.g. destination test), and b) ensure that the evolving needs of social enterprises are being met by creating a new legal framework under federal jurisdiction (e.g. Benefit Corporations)

Implementing these recommendations would ensure that:

· The social enterprise sector develops more rapidly, effectively and efficiently;

· The mounting energy of the expanding community of social entrepreneurs is harnessed;

· Communities and individual investors have more ways to invest in meeting community needs; and

· Private capital markets become a major source of capital to social enterprises.

The Opportunity of Social Enterprise and Social Finance

Social enterprise: Revenue-generating charities or nonprofits, cooperatives, or social purpose ventures acting as a business that use market-oriented production and sale of goods and/or services to pursue a public benefit mission and whose surpluses are reinvested (wholly or partially) for the purposes of the business or in the community, rather than being driven by the need to maximize profit for shareholders.

Social finance: actively placing capital in businesses and funds that generate social and/or environmental good and (at least) a nominal principal to the investor.

There has never been a more important time for social enterprise in Canada. Boston Consulting Group’s (BCG) study of the Social Impact sector in Canada (i.e. enterprising charities, revenue-generating nonprofits, social purpose businesses) calculates the market to be in excess of $200 B. Significantly, 35% of these entities were engaged in commercial activities for public benefit. The numbers of enterprising nonprofits are increasing steadily with BCG conservatively estimating their growth at 10% per year.

On the capital supply side, the current social finance assets under management in Canada total $2.7 B[iii] but untapped pools of private capital on the margins of the market await investment opportunities that generate social and environmental returns. New approaches are needed that leverage private capital and effectively enhance the financial resiliency of the non-profit sector and reduce its dependency on donations and grants.

Despite the burgeoning growth and awareness of social finance and social enterprise, the sector is lacking the enabling regulations and infrastructure required to reach its full potential. The way forward has been well documented in a groundswell of research conducted by numerous associations, think tanks and initiatives[iv] including Imagine Canada, the Public Policy Forum, CCEDNet, The Mowat Centre for Policy Innovation, The Tri-Ministerial Partnership Project (Ontario), and the Canadian Task Force on Social Finance.[v]

In addition, Canada can benefit by learning from other governments that are ahead of the curve in developing their social enterprise sector, predominately the United Kingdom[vi] and the United States.

At a macro-level, social enterprise provides a bridge between for-profit and non-profit realms while prioritizing solutions that provide tangible public benefit. Social enterprise can play an important role in helping deliver increased business productivity and competitiveness while growing participation in economic development and sustainability at the community level.

In the same way that our founding fathers enabled the construction of vital national infrastructure, such as the cross-Canada railway that unified the country, today Parliament can ensure that the nascent infrastructure serving social enterprises goes to scale so that the social enterprise sector becomes a key factor strengthening the social and economic fabric of communities across Canada.

Current Barriers Stalling the Opportunity

Demand, supply and regulatory functions of the social finance marketplace need to be wholly activated to enable a fully functioning market. Other barriers broadly identified as pain-points hampering the sector include:

· A lack of common understanding and awareness about social enterprise;

· An underdeveloped ability to measure impact and added value of social enterprise, hampered by the lack of standardization;

· Fragmented, sub-scale, and isolated market infrastructure;

· Limited availability and difficulty accessing appropriate capital pools.

Finance Policy Recommendations to Support the Opportunity

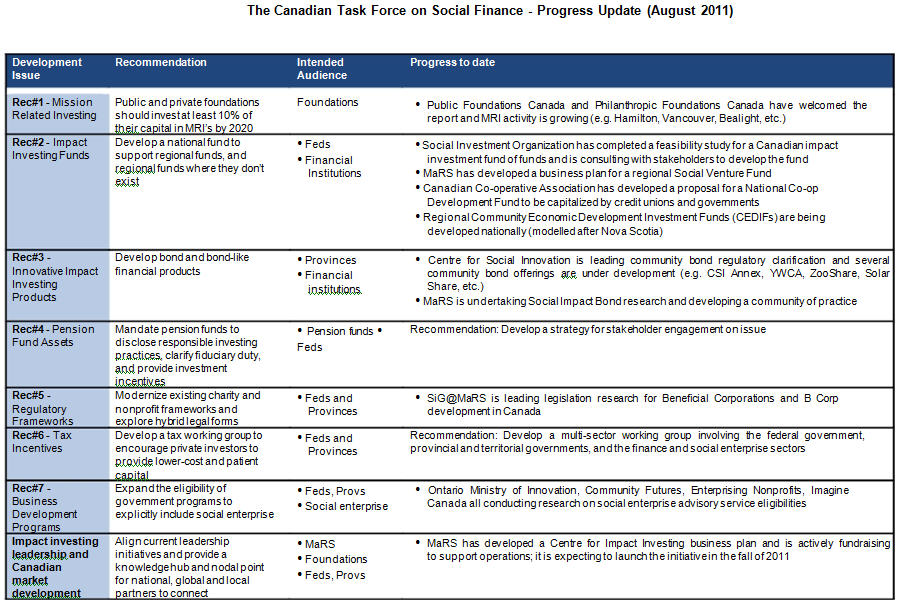

The Canadian Task Force on Social Finance was convened in 2010 to determine how best to catalyze the creation of a financial marketplace serving social enterprise. It recommended seven key actions that Canada needs to undertake, in parallel, to mobilize new sources of capital, create an enabling tax and regulatory environment, and build a pipeline of investment ready social enterprises. It also recognized government’s vital role in incentivizing the mobilization of private sector participants in the creation of new funding instruments and structures for the development of the new social finance marketplace. A summary of Task Force recommendations and the progress to date is found on Page 5.

The Task Force on Social Finance makes three priority recommendations related to mobilizing private capital and creating enabling legislative and regulatory frameworks for social enterprise:

I. Mobilizing Capital

The federal government should stimulate capital market formation by partnering with financial institutions to create national and regional impact investment funds that serve social enterprises.

Cost Implications: $100 M ($20 M annually for 5 years), conditional on private sector matching

II. Enabling Private Investment via Tax Environment

Creating tax incentives that accelerate the creation of a private capital market serving social enterprises.

Cost Implications: Tax expenditure to be determined based on outcomes of a proposed multi-sector tax working group involving governments (federal/provincial/territorial), the finance sector and the social enterprise sector

III. Modernizing Legal and Regulatory Frameworks

a) The Finance Department needs to modernize CRA regulations inhibiting charities and nonprofits from developing in-house or stand-alone social enterprises (e.g. destination test), and b) ensure that the evolving needs of social enterprises are being met by creating a new legal framework under federal jurisdiction (e.g. Benefit Corporations)

Cost Implications: Zero-cost legislation and there would be an expected increase in economic benefits by increasing employment for vulnerable populations and reducing strain on social services

A Way Forward

Government should make social finance development an integrated feature of its economic and social agenda7 and recognize that its goals support community economic development, encourage the development of new ways to deliver social benefits to the public, and empower communities with the tools needed to deal with local challenges.

Specific to the recommendations, government should work with leading institutions who have conducted relevant research and set-up cross-jurisdictional, cross-ministerial working groups to explore viable options for each of the recommended actions. Through this engagement and the subsequent positive action, government will enable local communities to be more active and successful in meeting local needs.

[i] See page 5 for a progress update on Task Force on Social Finance initiatives

[ii] Preliminary results of Social Impact Sector survey, Boston Consulting Group, 2011. (Breakdown: Quasi-government, $135B; Charities, $65B; Revenue-generating nonprofits, $30B, Social Purpose Business, $2-3B; CSR programs, $2B)

[iii] “Mobilizing Private Capital for Public Good,” Task Force on Social Finance, 2010

[iv] Links to the accompanying reports: Mowat, Partnership Project, Task Force on Social Finance

[v] The Task Force on Social Finance is comprised of business, public-policy, and philanthropic leaders who are concerned about the lack of capital available to address pressing social needs. It includes: Chair, Ilse Treurnicht (CEO MaRS), members Tim Brodhead (former President, McConnell Family Foundation), Nancy Neamtan (President, Chantier de l’economie sociale), Tamara Vrooman (CEO Vancity), Bill Young (President, Social Capital Partners), Sam Duboc (Founder Edgstone Capital), Tim Jackson (VP University of Waterloo), Rt. Hon. Paul Martin, Reeta Roy (CEO MasterCard Foundation), Stanley Hartt (Chair, Macquarie Capital Canada)

[vi] Refer to the UK Governments latest report on social investment, “Growing the Social Investment Market: A vision and strategy”, 2011. (The 2009 Standing Committee on Finance recommended: “the creation of a corporate structure for not-for-profit organizations that would allow the issuance of share capital and other securities”; In the 2011 Federal Budget, the government recognized the Task Force on Social Finance and said that it “will consider opportunities to leverage social venture financing through innovative partnerships that can demonstrate cost savings while maintaining or enhancing service levels.”